Our Investing Strategy

How Do We Protect Our Private Investor’s Capital?

Every week we analyze hundreds of properties in order to pick the ones that work within our criteria. We only go after low risk, high opportunity properties that will produce in TODAY’s market – we do not rely on appreciation of assets.

- We purchase properties at 10-50% of their value, maximum

- This gives us equity from Day 1 and makes us more resistant to any market recession

- We have defined exit strategies

- Knowing our plan and timeline gives you clear direction on when & how you will get your investment back

- We have an extremely lengthy due diligence process to ensure that our deals are as bulletproof as possible!

- Your money is secured as a lien against our projects

- This guarantees that your investment is protected

Project Cost: $17,418.84

Sale Price: $41,000.00

Timeline: 3.5 Months

Project Cost: $46,072.89

Sale Price: $90,000.00

Timeline: 3 Months

Project Cost: $17,817.06

Sale Price: $99,000.00

Timeline: 1 Months

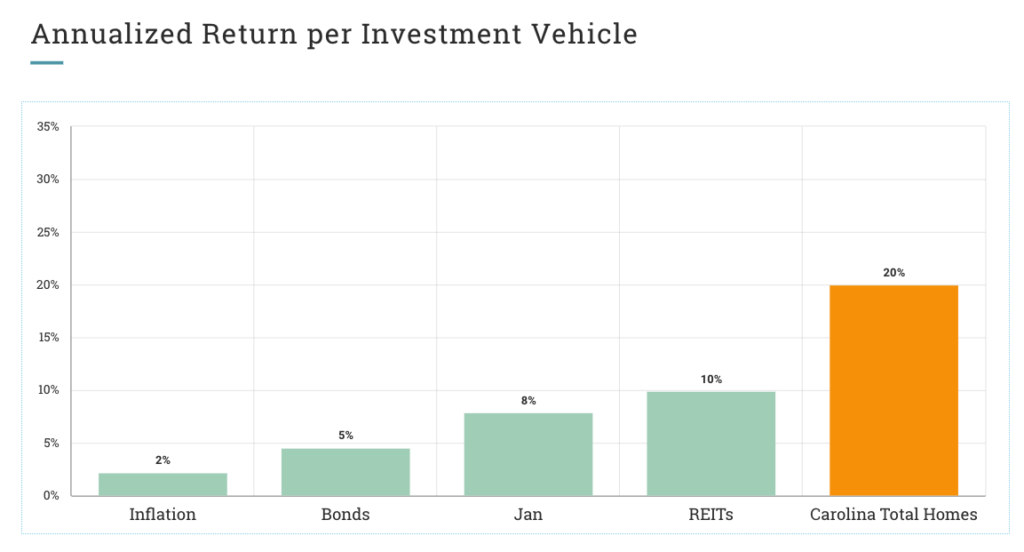

We offer investors guaranteed high returns with minimal risk

- 20% APR investment returns

- Fast returns – projects typically are less than 1 year

- Secured by real property with 50%+ equity

- Peace of mind – “Know” your returns vs. “hope” to get a high return

Source: J.P. Morgan Asset Management; Barclays, Bloomberg, Standard and Poor’s. REITs: NAREIT Equity REIT Index. S&P 500: Index average from 1957 to 2018. Bonds: Bloomberg Barclays U.S. aggregate index. Inflation: CPI. All returns listed are annualized.

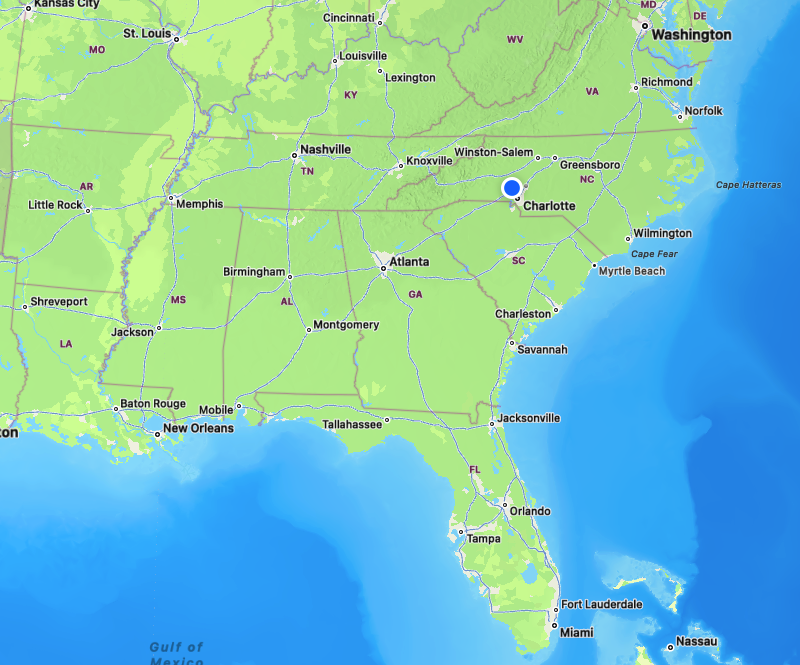

Invest in markets with continued GROWTH!

We heavily invest in the Southeastern US, because data shows that is where the majority of people are moving.

By targetting this geograhic area, we are even further hedging our bet by having a huge buyer’s pool. Many people are buying land from us for themselves, as well as MANY developers & builders.

Want to invest with us?

Enter your information below. We will reach out to discuss more about your goals, answer any questions & get you set up as one of our private investors.